Taxes

How to return 13 percent from the purchase of an apartment - a step-by-step process

Apartment owners have the right to refund taxes when purchasing an apartment. To do this, you need to contact the tax office, providing a declaration and a list of documents attached to it. After a certain period of time, in the absence of errors and shortcomings

Personal income tax reimbursement for treatment

Diseases are accompanied not only by physical suffering, but also by material expenses. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve exactly your problem

Declaration 3-NDFL: how to fill out correctly

From time to time there come times in our lives when we need a 3-NDFL declaration. Not all taxpayers know how to fill it out. And the fear of messing something up discourages people from doing this. However, everything is not so scary. The main thing is to pay attention

What tax is charged when selling a car?

If a person is going to sell his vehicle, he must know exactly how much tax will be charged when selling the car. After all, few people know that in certain cases this payment may not be claimed at all. Features

How to calculate tax when selling an apartment less than 3 years old

Issues related to the imposition of taxes on taxpayers living on the territory of the Russian Federation in favor of the state budget are always one of the most exciting. Many people want to improve their civic literacy and learn what

Tip 1: How to return a tax deduction

Who is under 24 years old. If the deduction is returned for treatment services for relatives, then you must provide additional documents confirming family ties, for example, a child’s birth certificate or marriage certificate. Medically

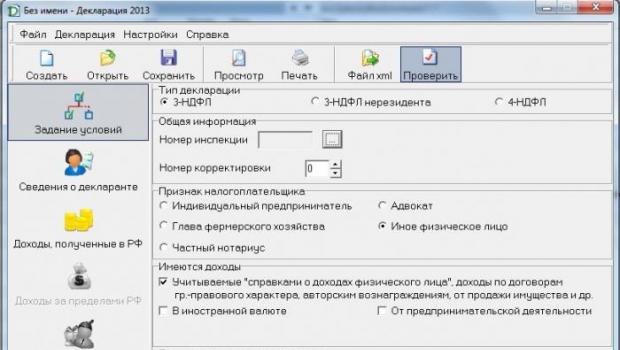

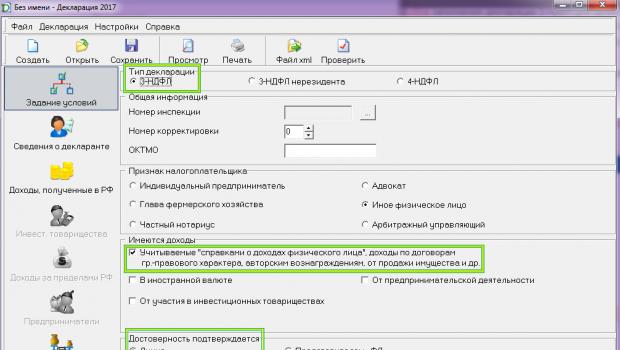

Filling out 3-NDFL in the “Declaration” program when applying for a deduction for the purchase of an apartment

Filling out an income tax return using special software is the second most popular way to prepare 3-NDFL for obtaining a tax deduction. Let us consider in detail how to fill out 3 personal income taxes in the “Declaration.2017” program when applying

How to pay apartment tax if you haven’t received a receipt

Why doesn’t the apartment tax arrive, or rather, a notification that reflects the size of the owner’s tax liability? There may be a lot of reasons, but that doesn’t make it any easier. After all, the absence of notification does not constitute an exemption for the taxpayer from the tax authorities.

Rules and procedure for returning tax deductions

The possibility of applying a tax deduction emphasizes the social nature of the state, which meets halfway its citizens who pay income tax (NDFL). Individuals who pay 13% personal income tax have the right to deduct the amount and

Tip 1: How to get money back for distance learning

You will need - declaration form 3-NDFL; - agreement with the institute; - copies of accreditation, license of the institute; - receipts for tuition fees; - passport. Instructions To receive a social deduction for training, ask where you are receiving your education by correspondence

Entrance

Entrance