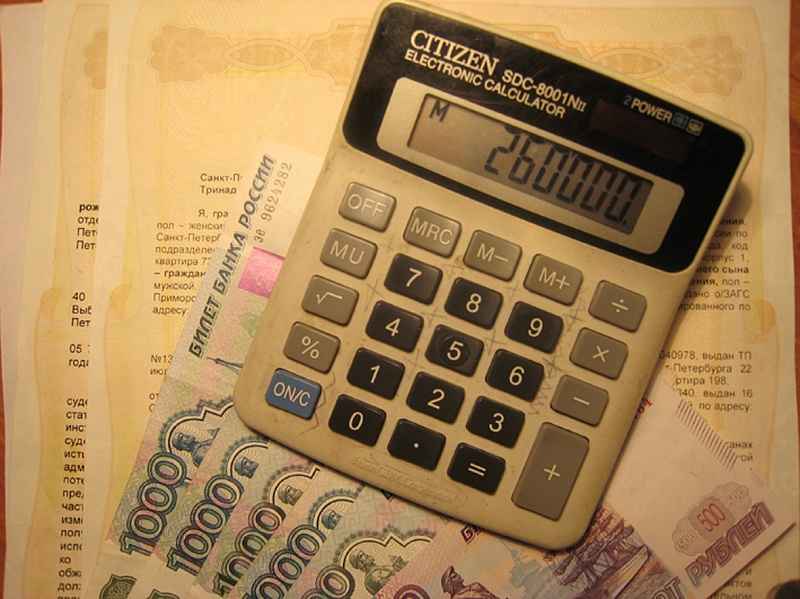

How to return 13 percent of the purchase of an apartment - a step-by-step process

Apartment owners are entitled to a tax refund when buying an apartment. To do this, you must contact the tax office, providing a declaration and a list of documents attached to it. After a certain period of time, in the absence of errors and shortcomings, the required amount of money will be transferred according to the details specified in the application.

Is it possible to return 13% of the purchase of an apartment

13% of the purchase of an apartment can be returned, but one should take into account the fact that this can be done only once in a lifetime. In addition, one of the most basic conditions for a tax refund will be the fact that a citizen must be employed. That is, the year preceding the return, the citizen is obliged to receive income from which income tax is paid.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

At the same time, it does not matter at all how many days or months a person received income. Refunds can be made even if the person officially worked for several weeks.

Main tax refund cases

There are several cases when you can get a tax refund:

- The first case is the purchase of real estate, namely an apartment, its share or a private residential building. You can also get a refund if you buy a room in a hostel.

- The second case is the purchase of land, on which it is planned to build a residential building.

- Now the majority of residential real estate is bought using a mortgage, that is, it is pledged to the bank until the loan is settled. And many are interested in the question, is it possible to return the tax in this case. Answer: Yes, of course you can. When building with a mortgage loan, a return is also possible.

- A very interesting case is the purchase of an apartment from a developer, but at the same time it is purchased in a rough finish. In this case, it will be possible to return the tax from the amount spent on its further repair, that is, bringing it to a state suitable for living.

The main cases when it is impossible to return 13%

But there are grounds on which the tax inspectorate has the right to refuse to refund income tax:

- Acquisition of an apartment or property from relatives. If you buy an apartment from the next of kin, then be prepared for the fact that you will be refused a refund. This situation can be considered in two ways, from the point of view of the tax between the next of kin, it would be possible to issue a donation, thereby relieving the donor (seller) from the obligation to pay income tax. After all, when making a donation between the next of kin, the parties are completely exempt from paying taxes. And when making a sale, the buyer receives the right to such a return. This is where selfish intent can be seen.

- The Tax Code of the Russian Federation also clearly regulates that a tax refund cannot be made if an apartment is bought with use of maternity capital, that is, part of the funds for its purchase comes from a certificate. Here is an example: an apartment is bought, worth 2 million rubles, of which part of the money comes from receiving maternity capital. Accordingly, when filling out the declaration in the column for the amount of income, it will be necessary to indicate the amount, minus the funds received from maternity capital.

- The pensioner is also not entitled to compensation. This is because this citizen does not have income that he would receive, subject to income tax at a rate of 13%.

- Accordingly, under the same category and fall completely unemployed citizens.

- faces, non-citizens of the Russian Federation are also not entitled to a tax deduction.

- It should be noted that if you buy an apartment individual entrepreneur, then there may also be difficulties with the return of the tax. If, in his activities, he uses a simplified taxation system, then, accordingly, he does not pay income tax in the amount of 13%, and therefore loses the opportunity to return it. If he is on the general taxation system and additionally pays income taxed at the above rate, then accordingly he acquires the right to receive a refund.

- There is another category of people who are temporarily unable to receive a tax refund. These are the so-called mothers on maternity leave. An employed mother, until the child reaches one and a half years old, receives an allowance from the place of work , calculated at a rate of 40% of the amount of the average monthly earnings. However, this benefit is also not taxed at the rate of 13%. Accordingly, while the mother is on maternity leave, it means she has no earnings, and she will have the right to file documents for a tax deduction when buying an apartment only upon leaving their parental leave.

Payout limits. Changes since 2014

Changes were made to this area in 2014. If your transaction is executed later than January 1, 2014, then you can get a tax deduction for several objects at once. The return limit is also set at 2 million. For example, you became the owners of two apartments at once, while the cost of each is 1 million rubles.

Also, since 2014, the deduction limit is determined based on the number of owners per apartment. That is, if an apartment purchased for 5 million rubles has two owners, then they have the right to receive a tax deduction based on the total amount of 4 million rubles. But at the same time, both owners must be working and have an income.

A limit on payments on mortgage loans has been set. It is from 3 million rubles. That is, if the cost of your apartment is 4.5 million rubles, then it will no longer be possible to return income tax from 1.5 million rubles.

Until January 1, 2014, the owners were entitled to a refund of income tax, the limit of which was limited to only 2 million rubles. At the same time, this could be done only from one property and once in a lifetime.

Ways to receive tax on the purchase of an apartment

It is necessary to indicate that the existing tax deduction, in the amount of 13%, can be obtained in two ways:

- Underpay this amount monthly to the budget. To do this, the employer must provide a package of documents and a notification from the tax authority. In this case, the income will be paid without withholding income tax in the amount of 13%. However, it must be taken into account here that deduction will not be made from the month following the month in which the said application was written to the employer.

- Get a deduction by submitting documents to the tax office. They are served, as a rule, at the place of residence. At the same time, they should be submitted before March 31 of the year following the reporting one.

How to return a tax deduction: a step-by-step process and documents for filing a tax return

In order to exercise your right of return, you must take the following steps:

- Buy and own an apartment. You must have legal documents in your hands.

- Obtain confirmation of the actual payment of income tax in the reporting period. Usually a certificate from the place of work is issued.

- It is necessary to prepare a declaration in the form of 3-NDFL. You can do this both independently and using the services of specialists. At the same time, it must be taken into account that in order to draw up a tax return, a certain package of documents will also be required, namely:

- Passport of a citizen of the Russian Federation.

- Help in the form 2-NDFL. You need to order it in the personnel department or accounting department of your enterprise.

- A contract of sale for an apartment, signed and duly registered. The act of acceptance and transfer of the apartment.

- If the deduction is made for the cost of finishing during the additional repair of the apartment, then all documents confirming these expenses incurred.

- The act of acceptance and transfer of funds or bank statements on their movement or other payment documents confirming the expenses incurred.

- It is necessary to prepare an application with a request for a refund of the specified tax. You can fill out the form on your own, using samples that are at each tax office, or contact specialists.

- Provide a copy of the savings book or the number of the personal account of the bank card, indicating all the full details for the transfer.

Declaration deadline

The deadline for submitting a declaration and a package of documents for receiving a tax deduction is set until March 31 of the year following the year for which you wish to make a refund. That is, if the apartment was purchased in 2015, then it will be necessary to submit documents to the tax office before March 31, 2016.

It should be noted, however, that these documents can be rented at a time for a period of three years, that is, considering the entire same apartment purchased in 2015, a refund for it can be required to be made in 2018. In this case, it will be necessary to confirm your income for 2015, 2016, 2017. In this case, the amount of the refund will not be no more than the one that you paid for the period of three years to the budget.

Buying a home with a mortgage: additional documents

For tax refunds, when purchasing an apartment using mortgage funds, you will need a slightly extended package. So, for example, when preparing a tax return, it will be necessary to provide a mortgage agreement with a mortgage, which is signed between bank employees and the buyer.

There are also a number of points that you need to consider if you are returning tax from an apartment purchased with a mortgage.

Again, mentioning the changes that came into force on January 1, 2014. So, if your apartment was purchased before January 1, 2014 and registered as a property, then you retain the right to a refund from the cost of the apartment, as well as the return of the same tax on all interest paid to the bank. And often the amount of return from all interest is much higher than from its cost.

In this case, you can make a refund while the mortgage loan is being paid.

If the ownership of the apartment was registered later than January 1, 2014, then the limit of 3 million rubles begins to operate here. And, accordingly, the amount to be returned, for interest, is limited to 3 million rubles. In the same case, you can apply for only by paying the entire amount of the principal debt under the mortgage agreement. And only then, upon presentation of a certificate from the bank, on the payment of the loan, you will be able to return the tax on interest paid.

When the tax authorities will transfer money for income tax refund

The deadline for making a decision on the transfer of funds is three months. Exactly one more month is given for the work of the translation itself. The term is quite long and it will be necessary to be patient. During the first three months from the date of submission of the package of documents, the tax authority appoints a desk audit. In its course, all the facts reflected in the declaration are established and verified, the reliability of information on the transfer of taxes is verified.

The result of such a check is a decision to transfer funds or to refuse. Reasonable grounds must be indicated in the refusal, with references to. This notification is sent to the applicant by mail. As a rule, when submitting a tax return, the applicant indicates his phone number, by which tax officials can contact you and inform you about the decision made, and, if necessary, about supplementing documents or urgent correction.

If the tax authority decides to refund income tax, then within a month, from the date of the end of the in-house audit, funds are credited to the account specified when applying for a refund. Thus, the total period from the moment of submission of documents to the moment of receipt of funds can be up to four months.

These actions and decisions of the tax authority are very convenient using the "Taxpayer's Personal Account" service. Access to this data can be obtained from the tax office in your place of residence.

Entrance

Entrance