Conditions and how to calculate a mortgage in the Russian Agricultural Bank

Analyzing the terms of the mortgage at Rosselkhozbank in 2017 and the interest rates on it, you can see that they significantly depend on the status of the borrower and other factors. Let's take a closer look at how interest is formed, what requirements apply to borrowers and try to calculate the amount of the monthly payment on a mortgage calculator.

Rosselkhozbank offers several mortgage programs for different people and different financial situations in 2017. The terms of the basic mortgage lending program will be of interest to most, so we will analyze them first.

The terms of the basic program are:

The spouse of an individual is a mandatory co-borrower. An exception may be the presence of a marriage contract. In total, under the terms of the mortgage at Rosselkhozbank, you can bring up to 3 people as co-borrowers to increase the loan amount, even if they are not your relative.

The formation of the interest rate depends on the status of the client, the amount of funds raised and the size of the down payment. So, young families can count on more favorable conditions (a family in which one of the spouses is under 35 years old or a single parent under the age of 35 years old), individuals who receive wages at the Russian Agricultural Bank, “reliable” bank customers (who took and repaid a loan without delay) and employees of public organizations. You can also get a more favorable percentage when purchasing real estate from partners of the Russian Agricultural Bank (the current list can be found on the official website).

The interest rate is affected by the refusal to conclude a personal insurance contract. In this case, it grows by +1%. The table below lists all possible percentage values. But keep in mind that these values are written with full comprehensive insurance in mind.

| Purpose of the mortgage | Sum | Where to buy | Preferential categories of clients | Any individuals |

|---|---|---|---|---|

| Buying an apartment, townhouse with a plot of land or apartments on the secondary market | Up to 3 million ₽ | Partners | 8,95-9,00% | 9,10% |

| 9,15-9,20% | 9,30% | |||

| For young families | ||||

| 8,95-9,00% | 9,10% | |||

| Over 3 million ₽ | Partners | 8,85-8,90% | 9,00% | |

| 9,05-9,10% | 9,20% | |||

| For young families | ||||

| 8,85-8,90% | 9,00% | |||

| Acquisition of an apartment, apartment or tanunhouse with a plot of land on the primary market | Up to 3 million ₽ | Partners | 8,95-9,00% | 9,10% |

| 9,15-9,20% | 9,30% | |||

| Over 3 million ₽ | Partners | 8,85-8,90% | 9,00% | |

| 9,05-9,10% | 9,20% | |||

| Buying a house or land | No more than 20 million ₽ | 11,45-11,50% | 12,00% | |

The established interest rates do not change during the entire term of the mortgage. To complete the transaction, Rosselkhozbank must provide a full package of documents, including a certificate of income. The borrower himself has the right to choose the terms of debt repayment - differentiated or annuity payments.

Mortgage plus maternity capital

Maternity capital can be used as a down payment for the purchase of real estate. The amount of the first payment must be at least 10% of the price of the purchased property in the secondary market and at least 20% when buying in new buildings. You can apply for a mortgage without a down payment at the Russian Agricultural Bank, provided that there is an amount on the maternity capital account that is greater than or equal to the above values. Interest rates in this program are unchanged and correspond to the values from the table above.

As additional documents for filing an application, it is necessary to attach a state-approved certificate of maternity (family) capital and a certificate from the Pension Fund of the Russian Federation on the balance of money in his account (with the obligatory certification of the seal of the regional branch). After the conclusion of the mortgage lending transaction, it is necessary to transfer maternity capital money in 3 months to pay off the debt.

Target mortgage secured by existing real estate

in this Mortgage Lending Program of Rosselkhozbank, other real estate owned by an individual may act as collateral. Mortgage conditions are slightly changed: the maximum amount of allocated funds cannot exceed 70% of the assessed value of the collateral. The application package must be accompanied by all available documentation for the mortgaged property.

Rosselkhozbank's interest rates are also changing slightly. There are no bonuses for young families in this program and there is no difference between buying in the secondary or primary market. When choosing an apartment or townhouse in the amount of less than 3,000,000 ₽, the percentage will be fixed at 9.60% per annum for preferential categories of individuals and 9.75% for everyone else, and if the amount is more than 3,000,000 ₽ 9.30% and 9 .45% respectively. Those wishing to acquire their own home can count on an interest rate of 11.50% and 12.00% for the specified categories of customers.

Registration on 2 documents

This program allows you to get a mortgage only on 2 main documents, but the conditions of the Russian Agricultural Bank and interest rates will be tightened. To apply, you will need a passport of a citizen of the Russian Federation and a second identification document of your choice: a driver's license, a passport for traveling abroad, a certificate of an employee in federal power structures.

The main changes in the conditions of Rosselkhozbank are:

The main changes in the conditions of Rosselkhozbank are:

- Reducing the maximum mortgage amount to 8,000,000 rubles for Moscow, Moscow Region and St. Petersburg and to 4,000,000 rubles for other regions;

- Reducing the loan term to 25 years;

- Growth of the down payment up to 40% when buying an apartment and up to 50% when choosing your own house or townhouse.

The interest rate of the Rosselkhozbank also grows in comparison with standard conditions, the bonuses of a young family become unavailable. But you can still save money by making a purchase through bank partners. Mortgage interest rates for 2 documents can be seen in the table below.

Special offers from developers

Developers' special offers on mortgages in conjunction with the Russian Agricultural Bank are not valid in all cities. For today it is 7 companies in 4 cities — Moscow, Lipetsk, Izhevsk and Syktyvkar. Conditions and interest rates differ depending on the selected object and developer. In 2017, the minimum possible percentage in Moscow is 6.50% per annum, in other cities it may drop to 6.00%.

military mortgage

Housing lending program for military participants of the savings and mortgage system (NIS). Below you can find the conditions from the Russian Agricultural Bank:

Housing lending program for military participants of the savings and mortgage system (NIS). Below you can find the conditions from the Russian Agricultural Bank:

- The maximum amount of allocated funds is ₽2.23 million.

- The loan term is from 3 to 24 years, but must end before the borrower reaches the age of 45.

- The interest rate is fixed and is 10.75% per annum.

- Down payment of at least 10% of the apartment price.

How to calculate the amount of the mortgage of Rosselkhozbank on a mortgage calculator

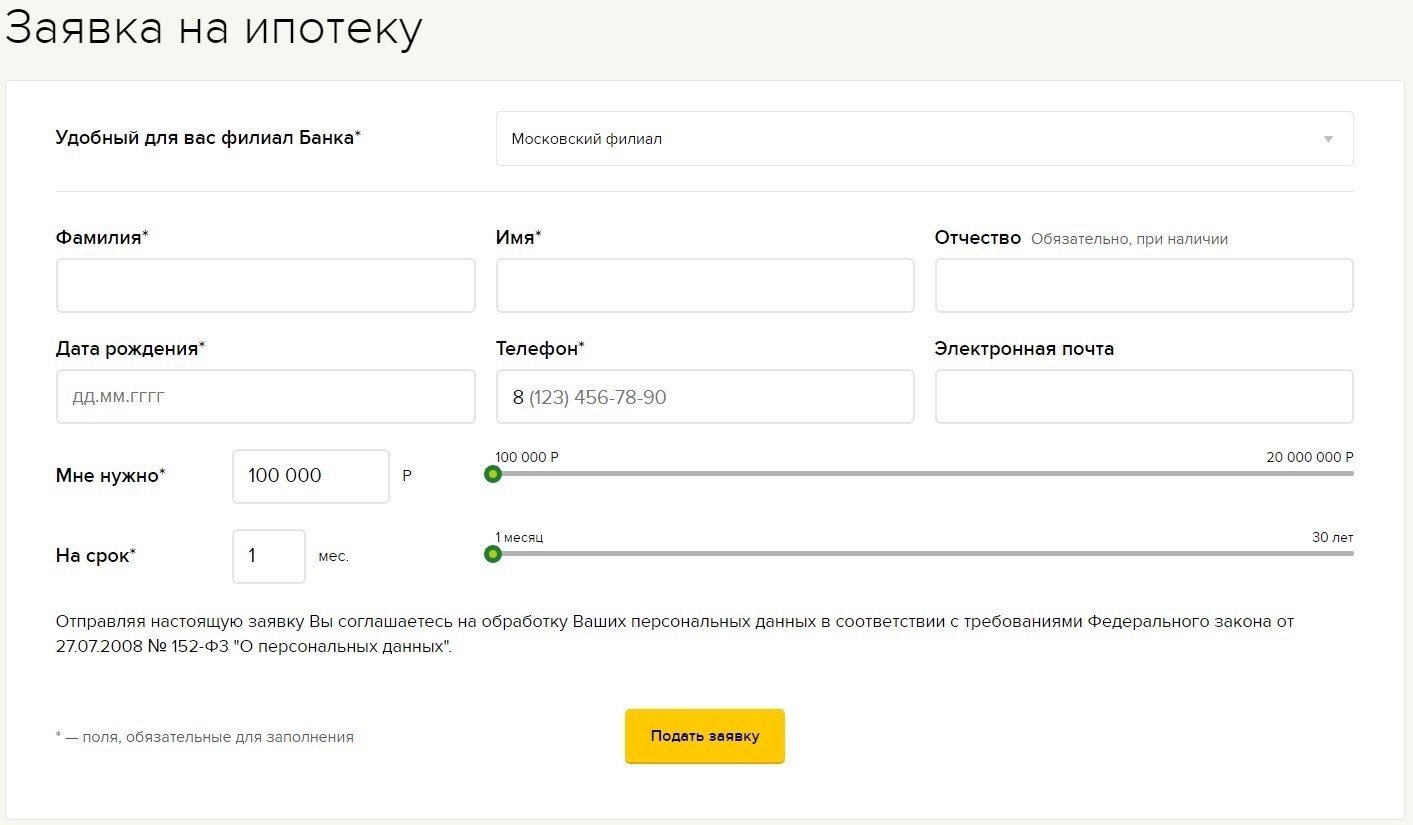

We recommend using the mortgage calculator below, which makes it possible to pre-calculate the amount of the monthly payment on the mortgage of Rosselkhozbank in 2017. After receiving the result, you can familiarize yourself with the schedule for changing the amount of payments.

To calculate the amount of the regular payment, fill in the corresponding lines of the calculator with the values of the interest rate (take from the table above and add 1% in case of cancellation of insurance), duration (standard conditions up to 30 years) and the amount of the mortgage (minus the amount of the down payment). The method of repayment is determined by the borrower and can take place both in an annuity way, that is, in equal parts, and differentiated, which means with a decrease in the amount of payment. It remains only to click the "Calculate" button and familiarize yourself with the graph and the result.

The mortgage calculator is for informational purposes only. The final amount of the interest rate, the amount of the monthly payment and other conditions can only be said by a specialist of the Russian Agricultural Bank after analyzing all the documents.

For the calculation on the mortgage calculator, thanks to the site calcus

How to apply online to Rosselkhozbank and what are the requirements for borrowers

Before applying, in addition to studying interest rates, we recommend that you familiarize yourself with the requirements for borrowers:

Before applying, in addition to studying interest rates, we recommend that you familiarize yourself with the requirements for borrowers:

- Individual citizen of the Russian Federation;

- The age of the borrower is at least 21 years and a maximum of 65 years, but they must come after the repayment of the debt;

- Work experience of at least 6 months at the current place of work and at least 1 year in the last 5 years (for people leading personal subsidiary plots from 12 months);

- It is obligatory to register in any subject of the Federation.

The most convenient way to apply for a mortgage is to submit an online application on the official website of the Russian Agricultural Bank. Filling out the form will take 15 minutes. After voicing a preliminary decision, it is necessary to take all the documentation to the bank branch. After that, the application is considered up to 5 working days and in case of a positive decision, you can engage in the selection of real estate. To choose an apartment or house, you have 90 days - this is how long a positive decision on a mortgage is valid.

Conditions and interest rates at Rosselkhozbank do not differ much from similar offers from other banks. If you decide to get a mortgage, then you should compare these programs with the rates of competitors and calculate the amount of payments on a mortgage calculator. This is the only way to be sure that you have chosen the most advantageous offer.

Entrance

Entrance