Get a mortgage with differentiated payments

Are you interested in which bank you can get a mortgage with a differentiated payment? Today we will tell you about which companies you should contact in order to get the most favorable loan offer.

As a rule, most banking organizations in our country work with . Their advantage is convenience - the borrower must pay the same amount every month, while the interest is charged on the balance of the debt under the agreement, regardless of how much the borrower contributes.

If we consider differentiated contributions, then they involve a gradual decrease in the amount that must be paid monthly: at the beginning of the term, you pay large amounts that decrease over time. This is convenient if you want to pay off your debt ahead of schedule, or pay off for a short period, because in this case the rate will be charged only on the balance of the debt.

If we conduct a comparative analysis of these two different accrual methods, it turns out that the annuity is less beneficial for the borrower. However, if you plan to repay the debt ahead of schedule, then it is better to choose an equal scheme so that the overpayment is less.

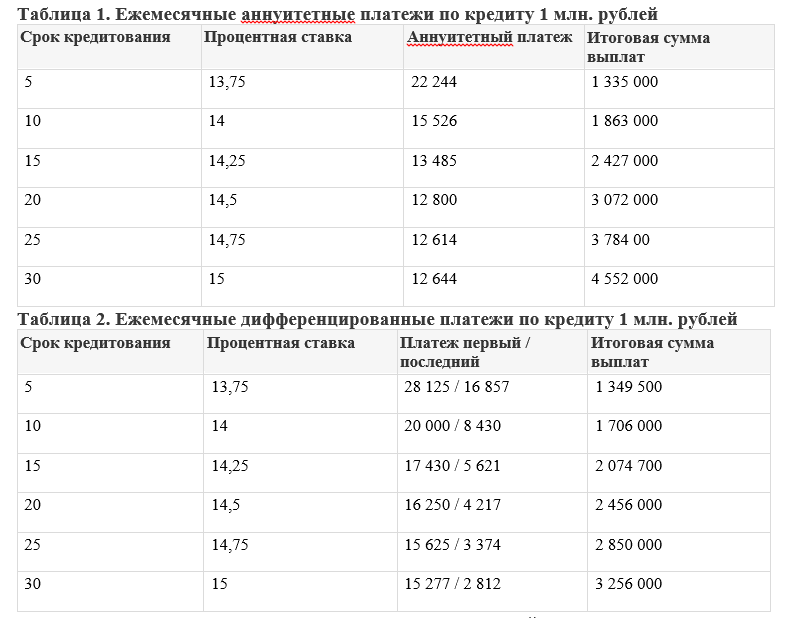

In graph number two, the greatest burden on the borrower falls during the first year. The ratio with income is calculated for this period.

Therefore, it is important that a potential client has a sufficiently large income to cope with a considerable burden on the budget. For these reasons, banks generally offer an annuity or lower the maximum loan amount based on an assessment of solvency.

We offer you the calculation at different interest rates:

Think about it, perhaps a loan for 30 years with a DP with a rate of 15% will be much less profitable than with an AP with a rate of 14% for 10 years. Before signing the contract, ask the bank employee to provide you with a payment schedule. Then compare it with the calculation from another company.

- Gazprombank- there are many programs that you can use to buy an apartment or townhouse, a private house, etc. It provides for the possibility of obtaining a preferential program, a military mortgage for NIS participants, a special offer for the purchase of real estate, which is pledged by the company. If you already have existing debt, you can refinance it here. A loan is issued against the security of property for repairs, we suggest you find out more in this article;

- IN Rosselkhozbank There is also a wide range of loan products, which allows you to choose the right option for each client. Here you will find programs for houses under construction and already finished houses, for country houses and land plots, the beginning and completion of construction. There are special offers for military personnel, young and large families, as well as those who want to draw up a contract with just 2 documents. Look for details on this page;

- at Nordea bank there are also options where the borrower can choose the order of payments. There are not many products here, most of them have a variable rate, which is "tied" to various indices, it is possible to obtain a foreign currency loan. More information can be found at

Entrance

Entrance